mississippi state income tax brackets

Because the income threshold for the top bracket is quite low 10000 most taxpayers will pay the top rate for the majority of their income. This means that your income is split into multiple.

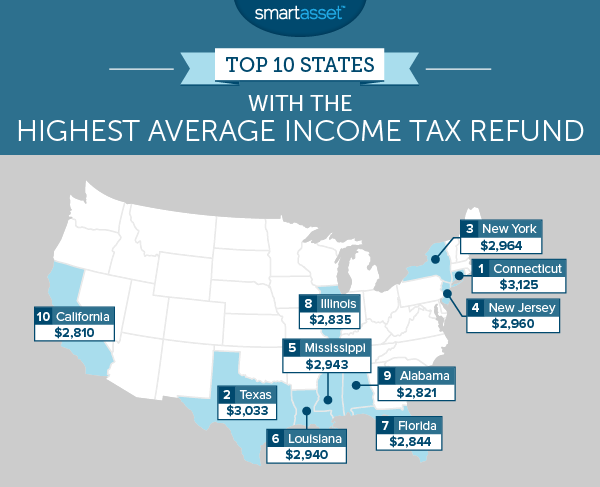

The Average Tax Refund In Every State Smartasset

These rates are the same for individuals and businesses.

. Mississippis income tax brackets were last changed four years prior to 2020 for tax year 2016 and the tax rates have not been changed since at least 2001. Any income over 10000 would be taxes at the highest rate of 5. Mississippi collects a state corporate income tax at a maximum marginal tax rate of 5000 spread across three tax brackets.

In Mississippi the 4 percent bracket applies to workers earning approximately 13300already a very large portion of the labor force. Here is information about Mississippi Tax brackets from the states Department of Revenue. The remaining states and Washington DC.

If youre married filing taxes jointly theres a. Individual Income Tax Notices. For single taxpayers your gross income must be more than 8300 plus 1500 for each dependent.

Each marginal rate only applies to earnings within. How many income tax brackets are there in Mississippi. Residents of Mississippi are also subject to federal income tax rates and must generally file a federal income tax return by July 15 2020.

Mississippi has a graduated tax rate. For single taxpayers your gross income must be more than 8300 plus 1500 for each dependent. Mississippi Income Taxes.

A State-by-State Comparison of Income Tax Rates. Because the income threshold for the top bracket is quite low 10000 most taxpayers will pay the top rate for the majority of their income. The income tax in the Magnolia State is based on four tax brackets with rates of 0 3 4 and 5.

Mississippi Income Taxes. Because the income threshold for the top bracket is quite low 10000 most taxpayers will pay the top rate for the majority of their income. Mississippi Code at Lexis Publishing.

The state income tax system in Mississippi has 4 different tax brackets. Mississippis maximum marginal corporate income tax rate is the 3rd lowest in the United States ranking directly below North Dakotas 5200. Mississippis income tax brackets were last changed four years prior to 2020 for tax year 2016 and the tax rates have not been changed since at least 2001.

The income tax in the Magnolia State is based on four tax brackets with rates of 0 3 4 and 5. The Mississippi Legislature is tackling income tax and how to get rid of it in the 2022 Legislative session. For more details check out our detail section.

In addition beginning in tax year 2020 the state now offers a bracket adjustment providing a scaled deduction for taxpayers with income of more than 79300 but less than or equal to 84600. Charge a progressive tax on all income based on tax brackets. Mississippi individual income tax rates vary from 0 to 5 depending upon filing status and taxable income.

Additionally the 4 percent bracket includes 5000 of taxable income meaning potential savings would amount to a maximum of 200 per year for single and joint filers. Hurricane Katrina Information Resources. The Mississippi income tax has three tax brackets with a maximum marginal income tax of 500 as of 2022.

See the TAP section for more information. On Tuesday the Mississippi Senate delivered an income tax cut plan that would phase out the four percent income tax bracket over four years. Mississippi state income tax rate table for the 2020 - 2021 filing season has four income tax brackets with MS tax rates of 0 3 4 and 5 for Single Married Filing Jointly Married Filing Separately and Head of Household statuses.

All other income tax returns P. Read the Mississippi income tax tables for Single filers published inside the Form 80-105 Instructions booklet for more information. Mississippi Income Tax Brackets and Other Information.

The Tax Relief Act of 2022 was announced by State Senator Josh Harkins Chairman of the Senate Finance committee. Married taxpayers must make more than 16600 plus 1500 for each qualifying dependent. Please wait at least eight to 10 weeks before checking the status of your refund.

For example Californias top rate is 133 but youll only pay this on income over 1 million. Box 23050 Jackson MS 39225-3050. Mississippi has three marginal tax brackets ranging from 3 the lowest Mississippi tax bracket to 5 the highest Mississippi tax bracket.

The state income tax system in Mississippi is a progressive tax system. Russ Latino president of Empower Mississippi said the chambers have come closer in their separate proposals addressing the potential elimination of income tax in the state. Married taxpayers must make more than 16600 plus 1500 for each qualifying dependent.

As you can see your income in Mississippi is taxed at different rates within the given tax brackets. What Are The Mississippi Tax Brackets. The more you earn the higher the percentage youll pay in income tax on your top dollars.

2020 State Tax Filing Deadline. The tax brackets are the same for all filing statuses. Here is a look at the income tax brackets for the state of Mississippi based on filing status.

Detailed Mississippi state income. Taxpayer Access Point TAP Online access to your tax account is available through TAP. Starting in 2022 only the 4 percent and 5 percent rates will remain with the first 5000 of income exempt from taxation up from 3000.

The income tax in the Magnolia State is based on four tax brackets with rates of 0 3 4 and 5. In Mississippi theres a tax rate of 3 on the first 4000 to 5000 of income for single or married filing taxes separately. In tax year 2021 only 1000 in marginal income will be subject to the 3 percent rate with the other 1000 exempt.

Mississippi State Tax Refund Ms State Tax Brackets Taxact Blog

Tax Rates Exemptions Deductions Dor

Extendoffice How To Calculate Income Tax In Excel

How Do State And Local Individual Income Taxes Work Tax Policy Center

State Income Tax Rates Highest Lowest 2021 Changes

Mississippi Tax Forms And Instructions For 2021 Form 80 105

Mississippi Tax Rate H R Block

The Most And Least Tax Friendly Us States

Mississippi Income Tax Calculator Smartasset

Mississippi Tax Rate H R Block

There Are 9 Us States With No Income Tax But 2 Of Them Still Tax Investment Earnings Business Insider India

States With Highest And Lowest Sales Tax Rates

Tax Friendly States For Retirees Best Places To Pay The Least

Which States Pay The Most Federal Taxes Moneyrates

State Corporate Income Tax Rates And Brackets Tax Foundation

Historical Mississippi Tax Policy Information Ballotpedia

List Of States By Income Tax Rate See All 50 Of Them With Interactive Map